Changes to dividend tax in the UK have dragged “millions” of investors into paying tax for the first time, according to investment platform AJ Bell.

Through a freedom of information (FOI) request, the firm found that 3.7 million people are expected to pay dividend tax this year, which has more than doubled since 2021/22, while the Treasury is set to raise over £18 billion in dividend tax this year alone.

The firm found that dividend tax has changed seven times in 11 years, with the latest rate hike coming in yesterday’s Budget.

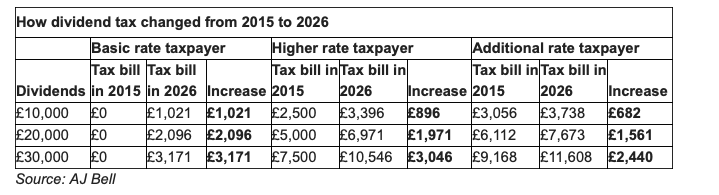

Laura Suter, director of personal finance at AJ Bell, said: “A basic-rate taxpayer with £10,000 of dividends a year, assuming they’d used their personal allowance already, would have paid no tax on dividends in 2015, but 10 years on they will be handing over £1,021 in tax on that income from April next year.

“Those with sizeable taxable dividends have seen their tax bill rise dramatically, with a basic-rate taxpayer on £30,000 of dividends paying no tax in 2015 and £3,171 from next April.”

She added that higher-rate taxpayers have faced an even bigger increase in their tax bills than additional-rate taxpayers thanks to the big hike in rates.

“Their rate has gone from an effective rate of 25% in 2015 to 35.75% from next year. In comparison, additional-rate taxpayers have seen a rise from an effective rate of 30.56% in 2015 to 39.35% from 2022,” she explained.

What has changed with UK dividend tax?

Ms Suter explained: “In 2015, basic-rate taxpayers enjoyed zero tax on their dividend income, thanks to a notional 10% tax credit that perfectly matched their 10% tax rate.

“When the tax rules changed in 2016, many were protected by the £5,000 tax-free dividend allowance, which when coupled with any remaining personal allowance that the individual had meant many were protected from paying any tax.

“But that allowance has since been slashed by 90%, to just £500 from 2024. At the same time dividend rates have ratcheted up over the years and from next year they will go up again, creating a double squeeze on those with even smaller taxable dividend amounts.”