Following news of Indian Prime Minister Narendra Modi announcing orders for more than 2,000 aircraft by the country’s airlines, portfolio manager John Ewart, Investment Manager of the Aubrey Global Emerging Markets Fund has said the country is set to be one of the most important sources of growth over the coming decade.

Modi commented that the orders marked the beginning of a period of rapidly expanding domestic aviation.

Ewart said: “Over the next ten years, we feel, one of the overarching themes will be the emergence of India as the third largest economy, and the source of much of the world’s growth. The country is predicted to grow 6.7% annually over the coming years, with GDP per capita rising to $4,000 by 2029, representing a doubling since 2020. It is the secure middle classes that drive spending. The top 40% of the income bracket spends $600bn per year and this is rising by some $50bn per year.”

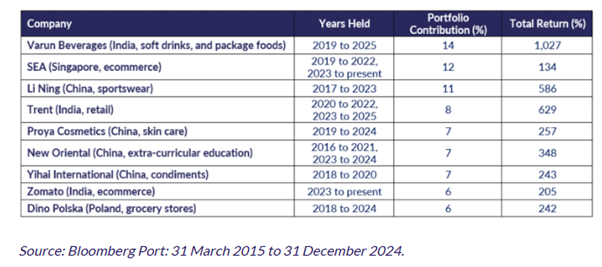

Along with portfolio management colleagues Andrew Dalrymple and Rob Brewis, Ewart earlier this year noted the attribution of Indian companies to the returns made by the EM strategy over the past decade, led by companies such as Varun Beverages, Trent, and Zomato.

In sectors such as ecommerce, India is significantly underpenetrated when compared with China in the EM space, thus standing out as an example of opportunities going forward. Demand for motor vehicles, specifically cars and motorcycles, continues to grow.