Underinvested, underinsured and over here – China’s wealthy on the move

By Will Grahame-Clarke, 11 Jun 18

China’s private wealth is growing at a break neck pace with four of its eastern provinces as wealthy as Portugal, according to analysis from Legal & General Investment Management (LGIM).

China’s coverage gap

With a lack of social safety nets and rising wealth, education and disposable income, the Chinese are becoming much more aware of the need to save for medical protection.

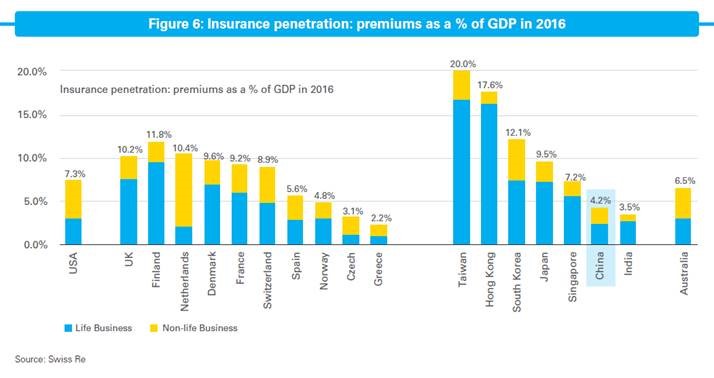

China currently is one of the least covered regions globally by insurance.

With awareness rising and the government having an incentive to reduce the burden on the state, Chinese insurance companies (eg AIA, Ping An, China Life and PICC) are insuring an increasing percentage of the population.

“Over the last year, the value of new insurance business growth in China has been 20% vs 12% over the previous five,” said Mazumder.

“By means of comparison, insurance penetration rose doubled in Japan between 1960 and 1966 and rose from 4.0% to 8.1% in South Korea between 1984 and 1990.

“If China were to catch up (adjusting for GDP per capita), new business would grow by a 15-20% compound annual growth rate from 2018 to 2025.”

Tags: China | Legal & General