The year of reckoning in the UAE… or not?

29 Nov 17

A lot of gloom is found in Insight Discovery’s flagship Middle East Investment Panorama (MEIP) for 2017, says its chief executive Nigel Sillitoe. Some 63% of advisers saw their clients’ lack of willingness to invest as a threat. Meanwhile, there were not many optimists. Only 18% of advisers saw their clients’ readiness to invest as an opportunity.

At first glance, it seems that the advisers interviewed for Insight Discovery’s flagship Middle East Investment Panorama (MEIP) have a cautious view of financial markets in late 2017. Some 43% told us that they see volatility of markets as a major challenge: slightly fewer – 39% – see a major opportunity. Only 18% have a strong view either way.

At 48%, 37% and 14% respectively, the corresponding numbers from late 2016 indicate that, collectively, the advisers have become a little less pessimistic over the past 12 months. Over that time, though, global fixed income and equity markets have performed well. In developed countries, especially, equity market volatility has been very low by historical standards.

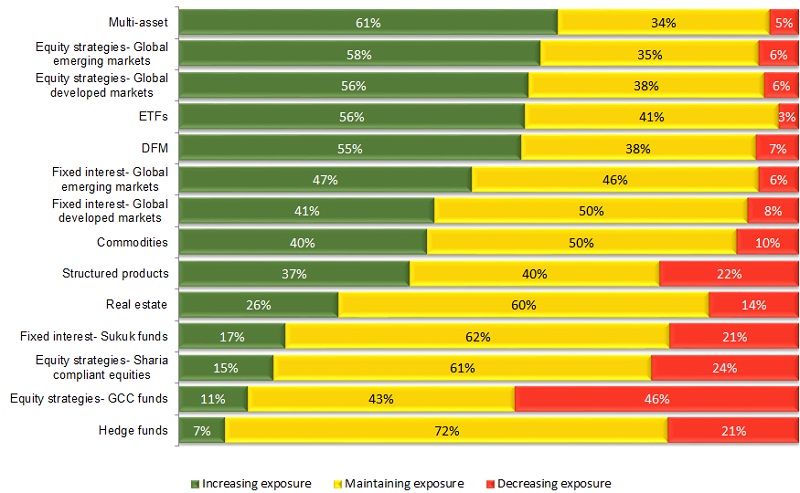

In fact, 58% of advisers anticipate that they will increase their clients’ weighting to developed markets equities over the coming year, while only 6% expect a reduction. The remaining 38% envisage that they will leave their allocations unchanged. The numbers for emerging markets equities are similar.

In relation to developed markets fixed income, the number of advisers who are looking to lift allocations – 41% – is considerably greater than the number who envisage a reduction – 8%. Nearly half of advisers – 47% – say that they will be boosting allocations to emerging markets fixed income.

Market volatility is a fact of life that many advisers are prepared to accept – even if they are naturally pessimists.

Tags: Insight Discovery | UAE