Every piece of legislation can be rather detailed and sometimes it takes someone in the legal profession to breakdown the grey areas of it.

UAE-based Insurance Authority’s BOD49 regulation on commission caps is no exception.

International Adviser recently discussed the formerly known Circular 12 in its Middle East regional piece, speaking to various people in the advice space in the UAE.

But what is the legal view on BOD49?

Separate set of rules

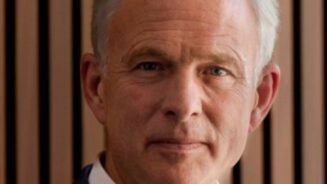

Tom Bicknell, partner at law firm Pinsent Masons, told IA: “Whilst not related to translation, the key area still requiring clarification is who will fall into the category of ‘investment adviser’.

“In previous drafts, this term did include advisers licensed by the Securities and Commodities Authority, but their role was limited to providing financial advice; they could not alone act on selling the product, which must be done in conjunction with a licensed broker.

“Previous drafts also had a comprehensive registration regime for any individuals involved in the advising and selling of life products including qualification and experience requirements.

“All of these provisions are not in BOD49 and our understanding is that this is because the Insurance Authority will issue a separate set of rules to complement BOD49 dealing specifically with advisers and individual sales personnel.”

Penalties and strictness

The English version document states that failure to comply with the legislation will result in penalties but fails to explicitly state what those penalties could be.

“The law is silent as to the particular actions that may be taken for breaches but we would expect the usual mixture of sanctions – in the form of licence suspensions and restrictions and public naming and shaming’ will apply – along with financial penalties,” Bicknell added.

One of the biggest shocks of BOD49 was after the legislation is published in the Official Gazette, there will be a six-month implementation period for firms to put provisions in place.

IA asked Pinsent Masons how strict will the Insurance Authority be about this implementation?

Bicknell said: “Originally there was a 24 month ‘phased’ implementation period so the six month period applying to all market participants has come as something of a shock.

“I would anticipate the Insurance Authority sticking to the six months at this stage with a potential for an extension to be allowed towards the end of the implementation period if it becomes clear that the market is not ready.”

Future work

There will be a lot of work expected for Pinsent Masons as the UAE advice sector gets ready for BOD49 to be implemented.

“We have been engaging heavily with the market with respect to previous iterations of BOD49 and our view is that most product issuers and brokers have a pretty good understanding of what the new regime means for them,” said Bicknell.

“That said, as with any law, there are areas of ambiguity that will require legal support.

“We will be reaching out to clients to ensure they understand what their obligations ahead of the end of the implementation period and helping them to action some of the changes necessary such as updating product terms, preparing illustrations and educating sales teams.”