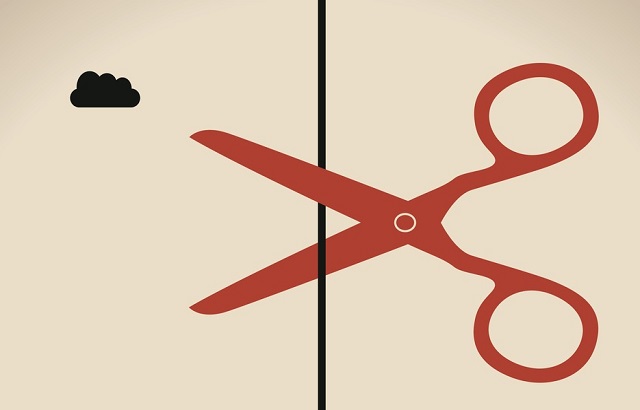

The UK’s chancellor is reportedly reviving plans to cut the tax-free limit on cash ISAs to push more savers to invest in the stock market, according to a report in the Financial Times.

This could include potentially halving it from £20,000 to £10,000 a year.

These plans were previously put on hold over the summer after lobbying by building societies, who warned Ms Reeves that they rely on cash ISA deposits to fund mortgages, and reducing inflows could potentially push up mortgage costs for homeowners.

But the report suggested that Treasury officials have been meeting with industry professionals over the past few weeks to discuss cutting the limit.

A Treasury spokesperson told the FT: “Cash savings are important for people looking to put cash away for a rainy day and we will protect that.

“But the chancellor has been clear that she wants to get Britain investing again, so British companies can grow and British savers who choose to invest can get more in return.”

Rob Morgan, chief investment analyst at Charles Stanley, said the plan may benefit both savers and the economy.

“Lots of people in the UK hold too much cash and not enough in investments, which is a missed opportunity to drive long term wealth creation,” he said.

“This reticence has negative ramifications for the success of the UK stock market and the wider economy too.

“While cash is essential for building short term financial resilience through an emergency fund and saving for shorter term goals, it fails to drive household wealth meaningfully forward over the longer term.”