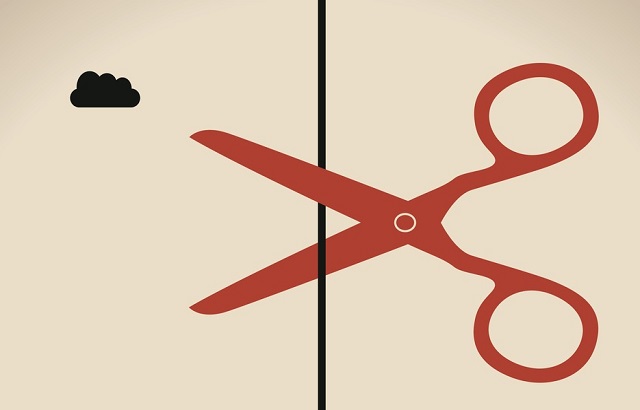

UK Chancellor Rachel Reeves is reportedly set to slash the annual cash ISA allowance to £12,000 in tomorrow’s Budget, according to reports.

The government is hoping the move will push more people to invest in stocks and shares ISAs instead of cash ISAs, which could boost the UK economy. According to HMRC, around 15 million adult ISAs were subscribed to ISAs in 2023/24 – just under 10 million of which were cash ISAs.

However, experts have repeatedly warned that they don’t expect cutting the cash ISA allowance will see a sizeable shift towards investing, and research suggests that most typical UK savers would opt to save into a taxable account over investing their money through a stocks and shares ISA.

Sarah Coles, head of personal finance at investment platform Hargreaves Lansdown, said:“We need an investment culture in the UK, and some of the money that has been saved in cash ISAs would work harder for people if it was invested instead, but there’s no evidence that cutting the cash ISA allowance would encourage them to make the change.

“When Hargreaves Lansdown surveyed clients as to what they would do in the event of a cut, they were equally likely to say a cut in the allowance would mean saving elsewhere as they were to say they would invest instead.”

The chancellor is widely expected to announce a raft of other tax tweaks to attempt to plug a multi-billion-pound black hole in the public purse.