Three Asia focused robo advisers compared

By International Adviser, 8 Aug 18

Three “robos” from the crucible of wealth tech share their data versus benchmarks

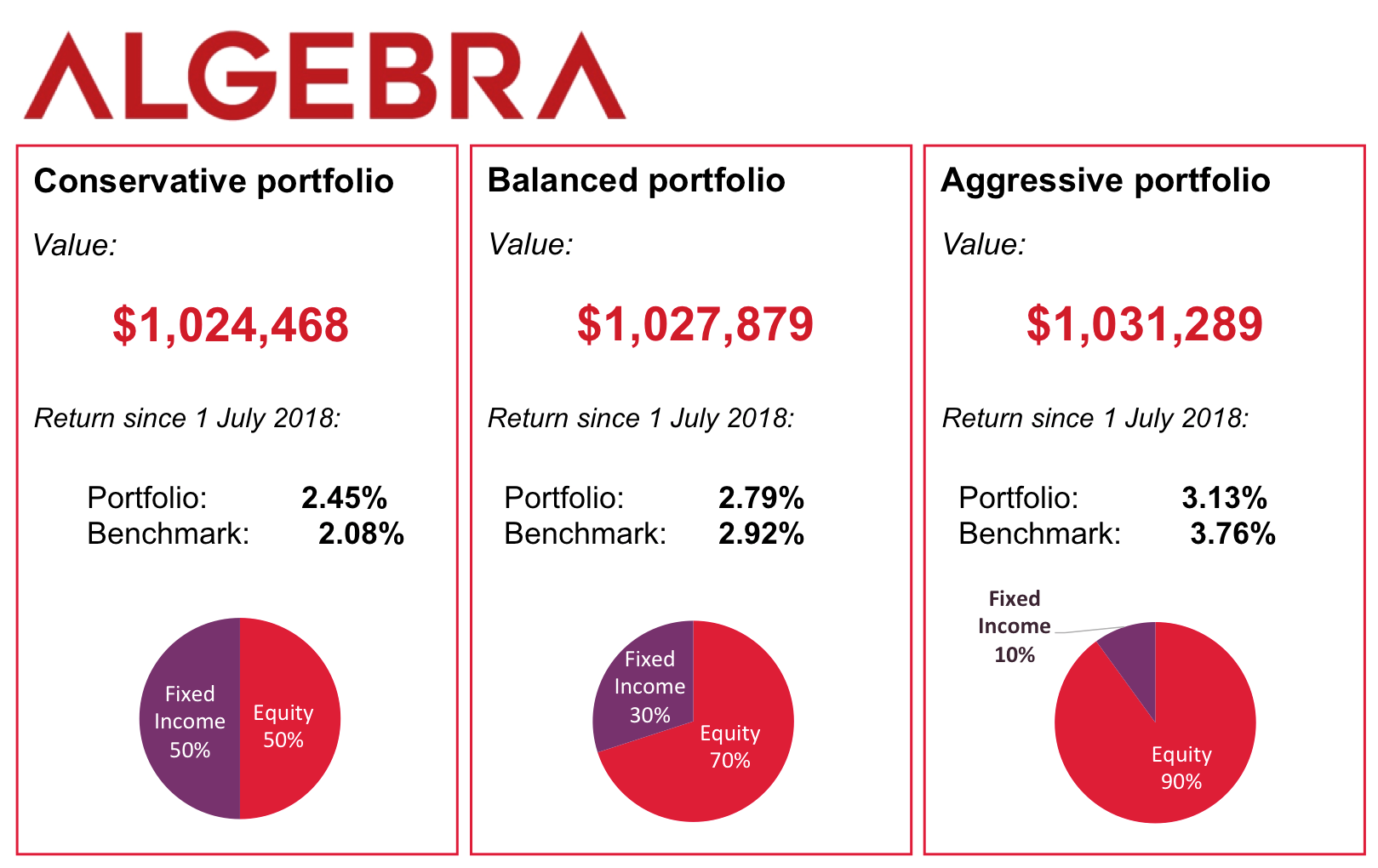

Algebra is a robo-advisor offered by Malaysia-based Farringdon Group. It was launched in July 2017. It offers sharia-compliant and conventional portfolios. FSA features three non-sharia portfolios.

The basis of Algebra’s portfolios is a smart-beta stock-picking strategy developed by Singapore-based Farringdon Asset Management. The portfolio consists of around 50 US stocks from the S&P 500 universe. They are selected based on the analysis of portfolios of ten highly rated active US equity fund managers. From each manager the algorithm chooses five stocks in which their fund is overweight, to include in the Algebra portfolio. The three model portfolios presented here contain a different allocation of fixed income to manage the risk profile. The annual fee is 0.85%.

Tags: Robo-advice