Three Asia focused robo advisers compared

By International Adviser, 8 Aug 18

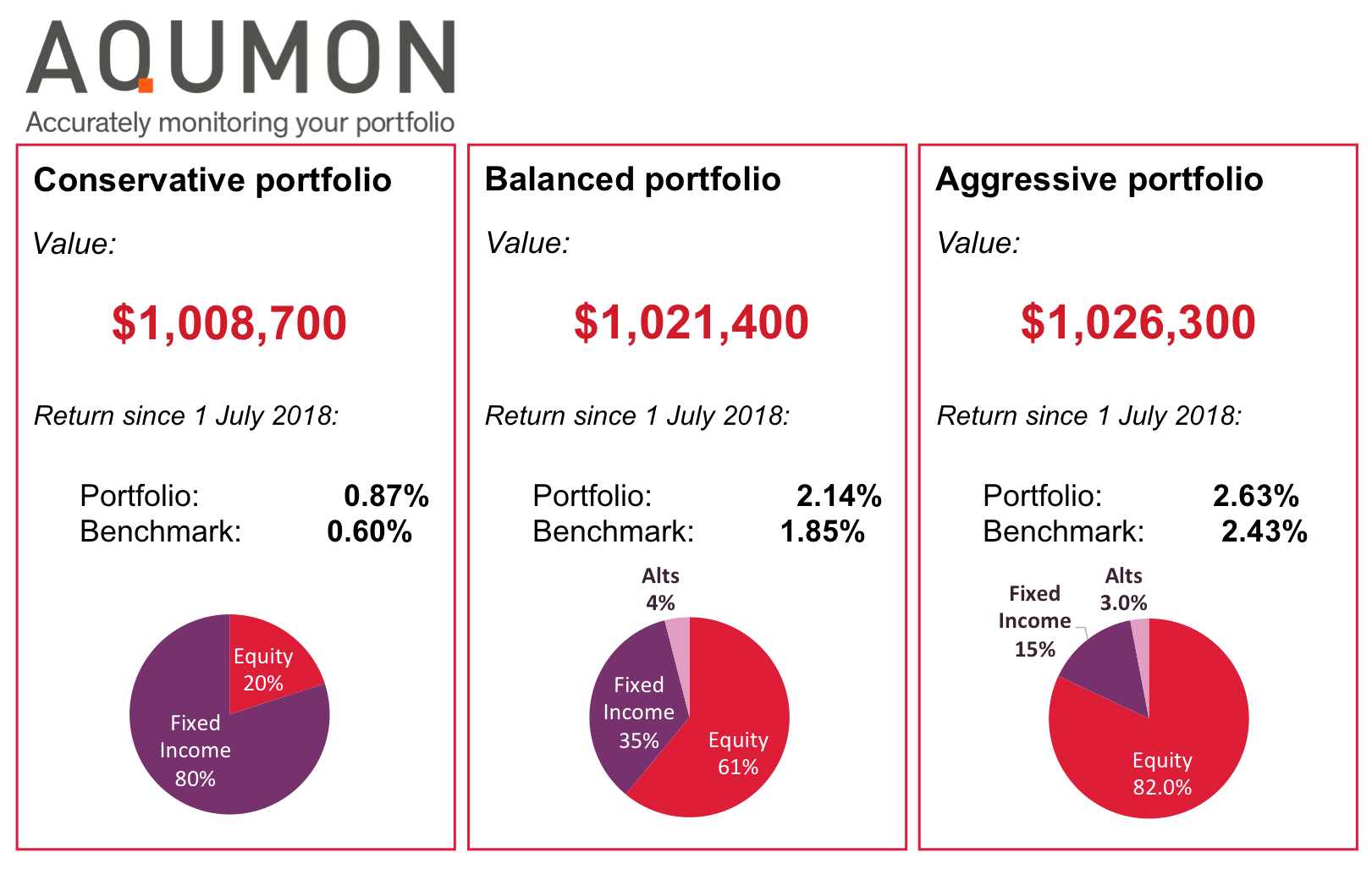

Three “robos” from the crucible of wealth tech share their data versus benchmarks

Hong Kong-based Aqumon, which launched last year, uses machine learning, a type of artificial intelligence, as part of the process to screen investment products and form allocation views to rebalance portfolios.

Aqumon can provide five-to-10 risk profiles for each client, co-founder Don Huang told FSA previously. Based on individual risk appetite, the service then creates a portfolio, which will have eight-to-10 ETFs for Hong Kong-based investors. In China, the robo-advisor makes use of mutual funds, as the costs of using ETFs are much higher than in Hong Kong and the US.

The service does not have a subscription fee and has a 0.8% annual investment advisory fee.

Tags: Robo-advice