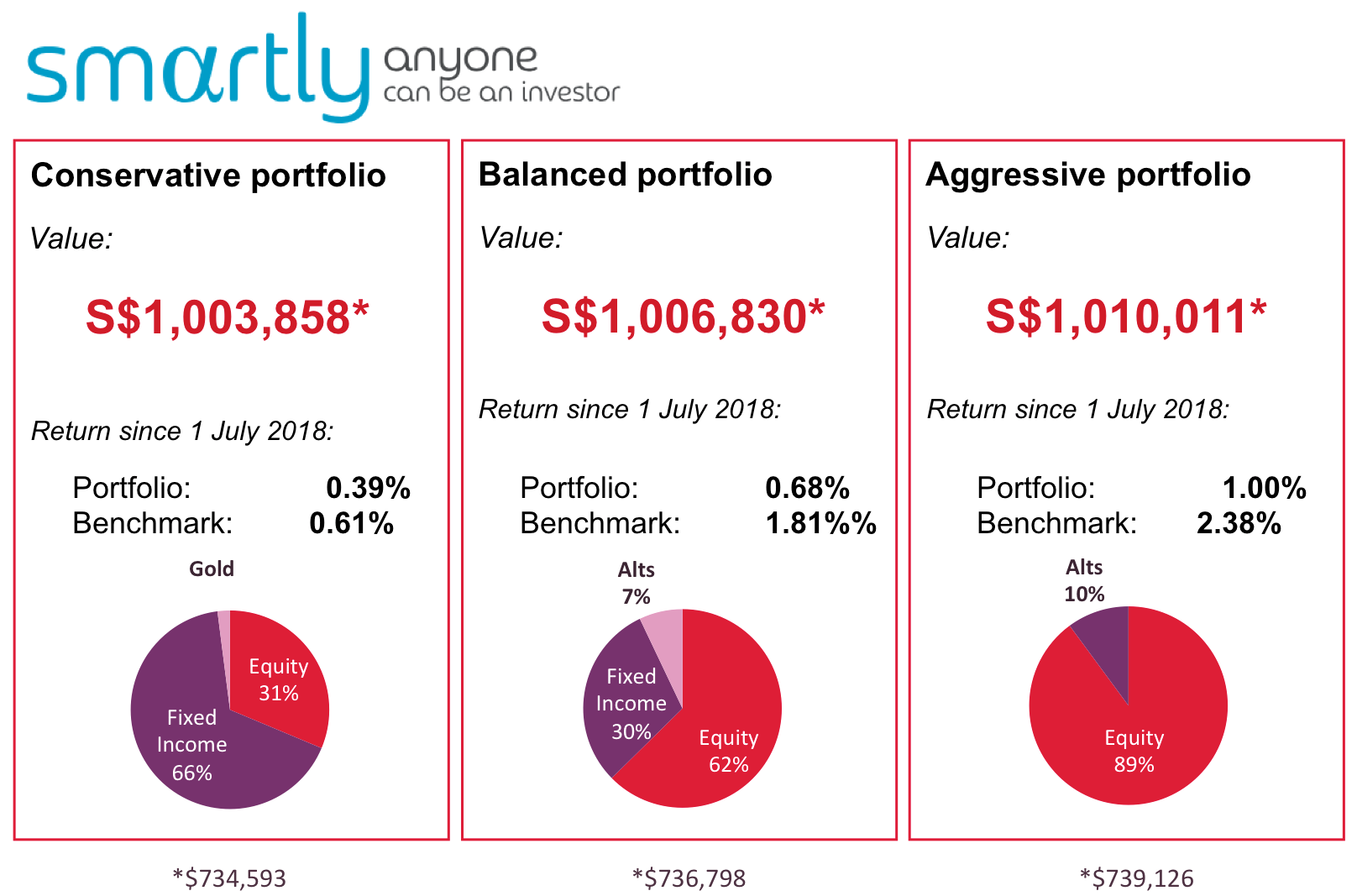

Three Asia focused robo advisers compared

By International Adviser, 8 Aug 18

Three “robos” from the crucible of wealth tech share their data versus benchmarks

Looking at various quantitative and qualitative criteria, the platform has around 20 ETFs on its shelf to choose from and may focus on equities, bonds, commodities, real estate or cash. It only selects physical ETFs, which means there are no derivatives involved.

When creating portfolios, Smartly uses the “Black Litterman” model, which is applied for its algorithms to measure the limitations of how much can be allocated to a particular ETF or a particular asset class or region in general. Portfolios are rebalanced regularly, as often as once a month.

The annual fee is between 0.5%-1% and there are no additional fees for rebalancing, withdrawals or trading.

Tags: Robo-advice